36+ Should i borrow the maximum mortgage

Borrowing the maximum amount that you can afford will mean youll have higher monthly payments and therefore more possible risk. What is your maximum mortgage loan amount.

100 Financing Zero Down Payment Kentucky Mortgage Home Loans For Kentucky First Time Home Buyers Kentucky First First Time Home Buyers Home Buying First Time

Maximum monthly payment is calculated by taking.

. Ultimately your maximum mortgage. Trusted VA Loan Lender of 300000 Veterans Nationwide. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you.

The general rule of thumb with mortgages is that you can borrow a mortgage that costs up to two and a half times your annual gross income. Apply Online Get Pre-Approved Today. Get the Right Housing Loan for Your Needs.

Lender Mortgage Rates Have Been At Historic Lows. The 2836 rule is a heuristic used to calculate the amount of housing debt one should assume. Contact a Loan Specialist.

When all things are considered like your debt down payment and mortgage rate you might find you could borrow as much as 6 or 7 times your salary for a mortgage. Try Our Maximum Mortgage Prime A Calculator This is your total principal interest taxes heat and 50 of your condo fee PITH. Looking For A Mortgage.

Get Your VA Jumbo Loan. That largely depends on income and current monthly debt payments. Contact a Loan Specialist.

This maximum mortgage calculator collects these important. Get Your VA Jumbo Loan. See how much house you can afford with.

It may create more financial risk. Trusted VA Loan Lender of 300000 Veterans Nationwide. Compare Offers Side by Side with LendingTree.

In other words if your maximum. Ad Easier Qualification And Low Rates With Government Backed Security. Ad Compare Your Best Mortgage Loans View Rates.

High-street lenders offer 55 times salary mortgages up to 85 LTV. Total household debt doesnt exceed more than 36 percent of your gross monthly income known as your debt-to-income ratio. Banks and building societies mostly use your income to decide how much they can lend you for a mortgage.

According to this rule a maximum of 28 of ones gross monthly income. VA Expertise Personal Service. However many popular loans with a max DTI of 43.

Take Advantage And Lock In A Great Rate. Be one of the high-borrowing 15. In general terms lenders want applicants to have a DTI ratio of 36 or less.

VA Expertise Personal Service. Most future homeowners can afford to mortgage a property even if it costs between 2 and 25 times the gross of their income. The general rule of thumb with mortgages is that you can borrow a mortgage that costs up to two and a half 25 times your annual gross income.

Note that your monthly mortgage payments. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Find out more Mortgage lenders have had an absolute.

A lender may approve you for a mortgage up to a high amount but it might not make sense to borrow the full amount if your other non-home-related debts are high.

Use Our Mortgagecalculator To Help You Set Your Budget Price Your Payments See How Making Additional Paym Home Buying Tips Mortgage Calculator Calculators

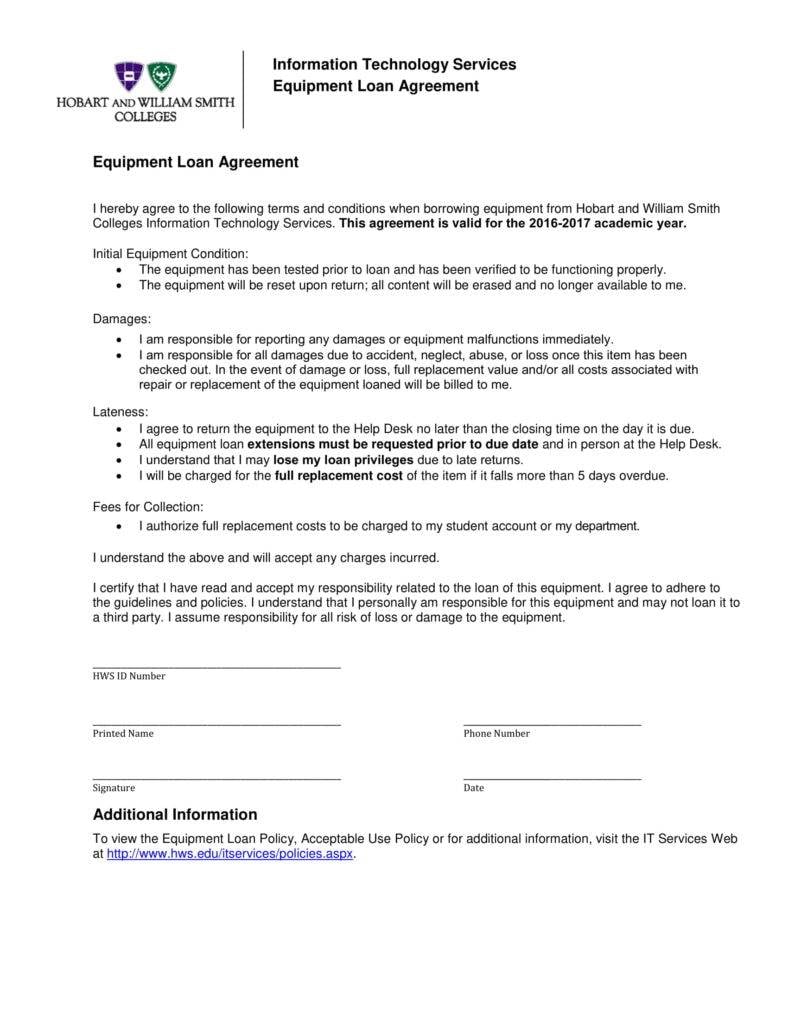

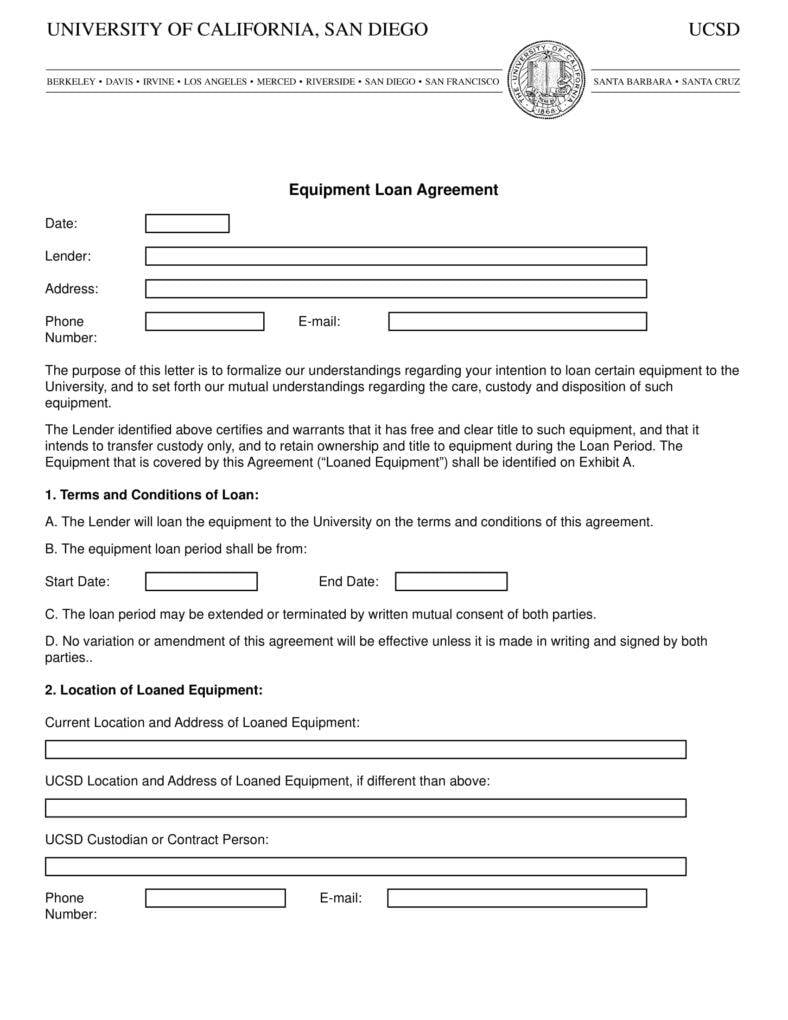

6 Equipment Loan Agreement Templates Pdf Word Free Premium Templates

Mortgage Tips Mortgage Tips Tips Mortgage

2

Free 5 Small Business Loan Proposal Samples In Ms Word Google Docs Apple Pages Pdf

100 Financing Zero Down Payment Kentucky Mortgage Home Loans For Kentucky First Time Home Buyers Kentucky First First Time Home Buyers Home Buying First Time

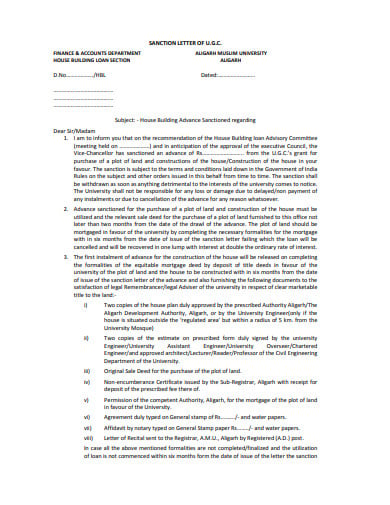

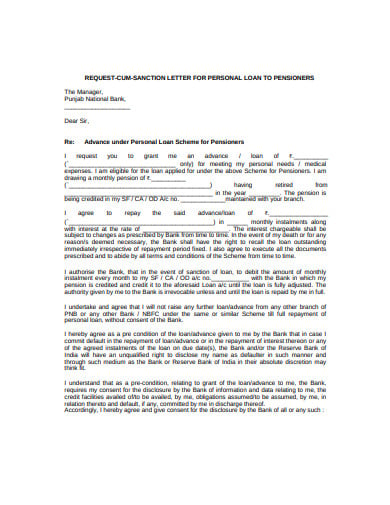

3 Loan Sanction Letter Templates In Google Docs Word Pages Pdf Free Premium Templates

3 Loan Sanction Letter Templates In Google Docs Word Pages Pdf Free Premium Templates

36 Sample Letter Of Explanation Templates In Pdf Ms Word

6 Equipment Loan Agreement Templates Pdf Word Free Premium Templates

3 Loan Sanction Letter Templates In Google Docs Word Pages Pdf Free Premium Templates

4id0gevyyh2ylm

How To Get A Mortgage From Pre Approval To Closing Home Improvement Loans Home Mortgage Refinance Mortgage

Fha Closing Cost Assistance For 2022 Fha Lenders In 2022 Closing Costs Fha Real Estate Tips

Investing Calculator Borrow Money

3 Loan Sanction Letter Templates In Google Docs Word Pages Pdf Free Premium Templates

Pros And Cons Of Fha 203k Loan Free Business Card Design Fha 203k Loan Business Card Design